PAYE: How to calculate personal income tax in Nigeria

If you earn an income and you live in Nigeria, you are expected to pay tax on your earned income called PAYE.. Pay As You Earn every month.

The administration of personal income tax (PAYE) is managed by the State Inland Revenue Service, and this has to do with your state of residence.

If you live in Lagos State for instance, but work in Ogun State, you are expected to pay tax to Lagos State and not Ogun.

Nigerian Personal Income Tax Laws have evolved over the years with several amendments introduced to align with the income of Nigerians.

The latest amendment was in 2012 when the Goodluck Jonathan Administration signed into law an Amended Personal Income Tax Act, replacing several controversial sections of the act with a simpler and easy to calculate taxable income.

The new amendments affect several sections of the Personal Income Tax Act, particularly Section 33 which deals with Personal Relief and Relief for Children, dependants, etc. This has now being replaced with a Consolidated Relief Allowance (CRA) of N200,000 + 20% of gross income.

They have also reviewed the Minimum Tax upwards from 0.5% to 1% and the Tax Table has also been notably amended.

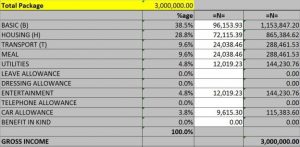

Let’s consider the example of a worker who earns N250,000 every month. That amounts to N3,000,000 per annum.

First Step

Let’s attempt to break down the N300,000 into basic, housing, transport and other allowances below:

Second Step

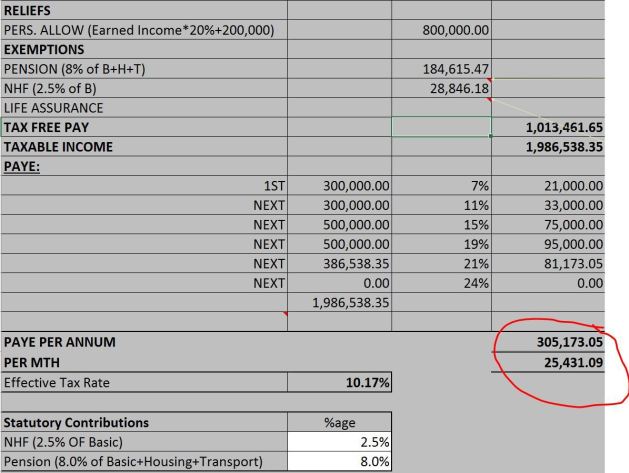

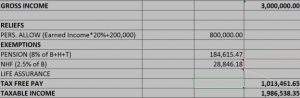

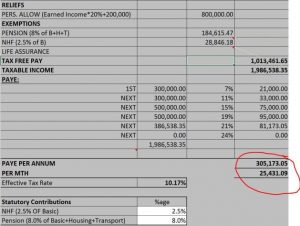

There are reliefs all tax payers are entitled to. The first one is the personal allowance which is 20% of earned income in addition to a fixed sum of N200,000. In our example of N3,000,000 annual earned income, this adds up to N800,000. Pension relief is 8% of total basic, housing and transport allowances. Whle NHF relief is 2.5% of basic allowance. Please note this relieves are only gotten if it is applicable in the organization in question.

Third Step

From the above calculations, total relief is N1,013,461.65 while taxable income is N1,986,538.35. The first N100,000 is taxed at 7%. The next 100,000 at 11%. The next 500,000 at 15% and the next 500,000 at 19% and the next 500,000 at 21%. The next 500,000 if any will be taxed ar 24%.

We can see from the above analysis that the worker will pay a monthly tax of N25,431.09.

READ ALSO! Skytrend Consulting: Financial services and accounting solutions company

READ ALSO! Why The North Remains Headquarters Of Poverty In Nigeria — Kingsley Moghalu

READ ALSO! For failing to give out ‘adequate loans’, 12 banks fined N499bn

READ ALSO! Nigerian Central Bank Approves Disbursement Of Loans For Creative Industries At 9%

READ ALSO! How To Empower Yourself And Generate Income From Mutual Funds

READ ALSO! Is N-Power Truly Empowering Nigerian Youths?

READ ALSO! TraderMoni: Poverty Alleviation Or Political Leverage?

[…] READ ALSO! PAYE: How to calculate personal income tax […]

Comments are closed.