VAT on online purchases: 8 Critical things you must know

By Femi Adeoya

From Jan 1, 2020, any online purchase you make in Nigeria will attract a tax bill which will be debited directly to your account by your bank.

The government in its plans to raise more revenue to fund our escalating budget demands, says it be introducing a 5% Value Added Tax (VAT) specifically for online purchases.

VAT is a consumption tax imposed on the cost of goods and services supplied in Nigeria except items specifically exempted.

VAT rate is presently put at 5% though there are plans to increase it to 7.5%.

This means for a price of N1,000 you will pay an extra N50 as VAT to government making your total bill N1,050. If the item is for your use or consumption then that is where the VAT story ends.

However if you resell the item or use it to produce something else which you will sell at say N1,500 then you need to charge VAT of N75 so the buyer pays N1,575. Since you paid VAT of N50 (input VAT) when you bought the item then you are entitled to deduct it from the VAT of N75 you’ve just charged (output VAT) and only pay the difference of N25 (N75 – N50) to FIRS.

According to Quartz Africa, “The online purchase tax proposal appears at odds with Nigeria’s long-held ambitions for a cashless economy given the possible effect of disincentivizing online purchases. If launched, it also adds to a growing number of existing charges Nigerian bank card holders already face, including a card maintenance fee.”

According to the blog, another potential effect is that Nigeria’s fledgling startups and businesses, possibly the biggest success story in the country in the last decade, may be caught in the crosshairs of the policy.

At their core, some tech companies in Nigeria have attempted to engineer a broad change in local social behavior by getting more Nigerians to adopt online purchases and payments. And, so far, that goal has already faced stumbling blocks in general skepticism around online payments given fears of fraud and early-day struggles with failed transactions.

“This will lead to a decline in use of cards online,” says Oluyomi Ojo, founder of Printivo, an online design and printing company. “Merchants will opt for bank transfers and customers will opt for other options. There’s no other way to look at the proposed policy than to see it as a card payment killer.,” he adds.

Many other stakeholders and financial experts have also expressed their worries over the government’s enforcement of the tax, adding that that the move would constitute a threat to businesses that operate in the country, particularly those in the e-commerce industry.

Peter Nwaobi, a tax expert at KPMG, however says that the proposed 5% VAT on online purchase is not a double tax and there were no initial charges on purchases.

Nwaobi explains that for every online transaction, there is always a 5% VAT on every item.

“Before now, for every time you get online, the merchant already charged 5% VAT on it, either you see it on slip or not. it is there.”

He said the fee is what the FIRS is running after as majority of the funds have not been captured in the tax net. “This idea will allow the merchant to remit the 5% they have charged to the bank (acting an agent in this instance).”

Chairman of Federal Inland Revenue Service (FIRS), Mr Babatunde Fowler on Monday clarified the introduction of the online tax: “All we are saying is that those who use online facilities, we will give instructions to the banks that once they make the payment, they will just charge 5% VAT and remit it as an agent to FIRS.

“By the VAT Act, the minister has the right to change the rate but this government, I believe wants to carry every stakeholder along including those in the house and explain to them that this increase is for the benefit of all Nigerians. And it will only apply to what I call privileged items like buying a car or lunch in an expensive restaurant. The money will help the state look after the needy among us,” he adds.

The FOUR things every consumer in Nigeria should know

1. All payment providers, credit cards and other electronic payment schemes in Nigeria will hold back 5% VAT on any transaction between a consumer and an online seller. This is where e-commerce comes into play.

2. The growth of the country’s Financial technology, (often shortened to FinTech) industry will slow down. Presently, Nigerians are gradually responding to FinTech initiatives, and despite all the campaigns, quite a number of people are still not financially included.

3. The VAT law has a list of goods and services that are not liable to VAT. Examples include educational materials like books, basic food items like raw yam, cassava, beans (once the food is cooked you may have to pay VAT), baby foods, fruits and vegetables, medical treatment, school education, etc. Also some transactions that are NOT subject to VAT because they don’t qualify as goods or services. Examples include land, company shares, borrowing etc

4. VAT applies equally to goods and services purchased online and offline. It does not matter whether you pay cash or through electronic means. If VAT is not being paid it is not an online problem, it is people choosing not to comply and FIRS not doing their job well.

Mondaq.com gave four categories of online transactions and the dynamics of VAT payment by the consumer.

1. Online sale of goods by local businesses (like buying a bag on Jumia)

2. Local services provided or ordered online (like Pay TV subscription to watch DSTV).

VAT is already being collected on categories 1 and 2 since the sellers are in Nigeria regardless of whether the transactions are done online or offline.

3. Online sale of goods by foreign sellers (like ordering a phone from Amazon)

On this category, VAT is already being collected by Customs at the point of importation except where the value of the item is small and legally exempt.

4. Foreign services provided or ordered online –

The challenge for Nigeria is this category 4. Examples include when you subscribe to Netflix or you pay for an advert to promote your post on Facebook or Instagram.

Mondaq.com further analyses why consumers and customers should care.

It says: “Government wants to ensure that online transactions don’t escape VAT but as demonstrated above only category 4 is really an issue and it constitutes a small percentage of online transactions in Nigeria.

So the FOUR questions for the government and its revenue agencies are:

1 How will the proposed measure by the FIRS address this problem?

2. How do we ensure that categories 1-3 don’t suffer double VAT?

3. If VAT is taken by the payment agent how will online sellers offset their input VAT?

4. How will the payment agents know if a transaction is exempt from VAT so they don’t charge VAT wrongly?

Call 0803 239 3958 for free financial consulting advice for your businesses.

Send your accounting articles to blog@skytrendconsulting.com.

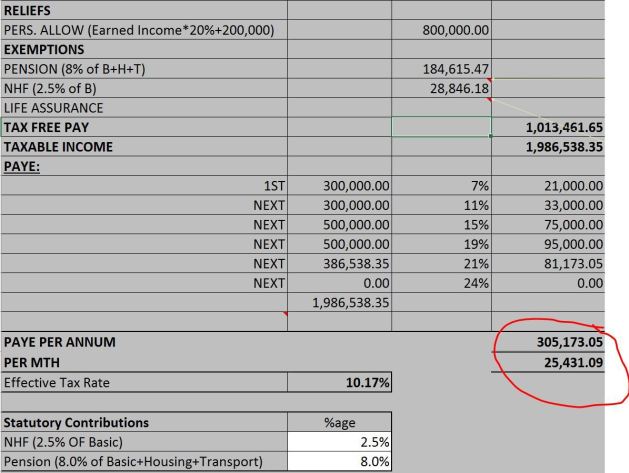

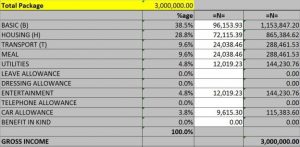

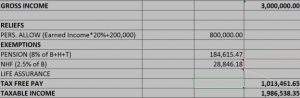

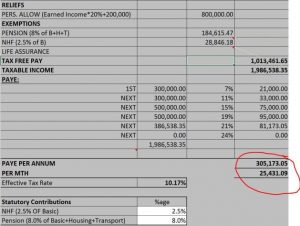

READ ALSO! PAYE: How to calculate personal income tax

READ ALSO! Skytrend Consulting: Financial services and accounting solutions company

READ ALSO! For failing to give out ‘adequate loans’, 12 banks fined N499bn

READ ALSO! Nigerian Central Bank Approves Disbursement Of Loans For Creative Industries At 9%

READ ALSO! How To Empower Yourself And Generate Income From Mutual Funds

READ ALSO! Is N-Power Truly Empowering Nigerian Youths?

READ ALSO! TraderMoni: Poverty Alleviation Or Political Leverage?