Accounting For Beginners: Rules Of Debit And Credits

Debit and credit are additions to or subtraction from an account. In accounting, debit refers to the left hand side of any account and credit refers to the right hand side.

Asset, expenses and losses accounts normally have debit balances; while liability, income and capital accounts are usually in credit balances.

The term debit is derived from the latin base debere (to owe) which is shortened to “Dr”. It’s used in accounting ledger entries to refer to debits. Credit comes from the word credere (like a creditor), which contracts to the “Cr.” used for a credit.

There are two MAJOR classifications of accounts:

A. Traditional Classification: Under this, we have Personal, real, nominal and valuation.

1. Personal Accounts:

A personal accounts are related to individuals, firms, companies, etc. For example – debtors, creditors, accounts of credit customers, accounts of goods suppliers, etc.

Action: Debit the account of the person who receives something and credit the account of the person who gives out something.

2. Real Accounts:

A real account is a general ledger account that does not close at the end of the accounting year. In other words, the balances in the real accounts are carried over to become the beginning balances of the next accounting period. Real accounts are also referred to as permanent accounts.

Action: Debit the account of the asset/property which comes into the business or addition to an asset, and credit the account which goes out of the business.

When furniture is purchased for cash, furniture account is debited (which comes into the business) and cash account is credited (which goes out of the business).

3. Nominal Accounts:

In accounting, nominal accounts are the general ledger accounts that are closed at the end of each accounting year.

The closing process transfers their end-of-year balances from the nominal accounts to a permanent or real general ledger account. The nominal accounts can also be referred to as temporary accounts.

Action: Debit the accounts of expenses and losses, and credit the accounts of incomes and gains. When salaries are paid, salaries account is debited (expenses) and cash account is credited (asset goes out).

4. Valuation Account:

In accounting, a valuation account is usually a balance sheet account that is used in combination with another balance sheet account in order to report the carrying amount of an asset or liability.

Action: Debit the account when the account is to be reduced and credit the account when the account is to be increased.

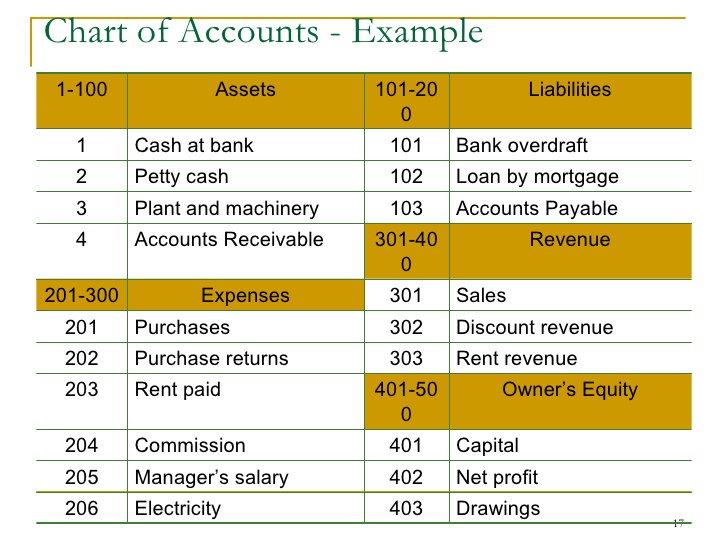

B. Modern Classification: We have assets, liability, capital, revenue, expenditure and withdrawal

1. Assets Account:

An asset account is a general ledger account used to sort and store the debit and credit amounts from a company’s transactions involving the company’s resources.

2. Liabilities Account:

Accounting statement which tracks how much a person or business owes a creditor. The liability account tracks debts owed to banks, vendors, employees and any other creditor who had not yet been paid for products or services received.

3. Capital Account:

Capital account gives a summary of the capital expenditure, investment and income of a business

4. Revenue Account:

Revenues are the assets earned by a company’s operations and business activities. In other words, revenues include the cash or receivables received by a company for the sale of its goods or services. The revenue account is an equity account with a credit balance.

5. Expenditure Account:

An expenditure represents a payment with either cash, transfer, debit card or credit to purchase goods or services.

An expenditure is recorded at a single point in time (the time of purchase), compared to an expenses which is allocated or accrued over a period of time.

Withdrawal Account:

Withdrawals or owner’s withdrawals (called drawing) are payments from an owner’s share in a company. In other words, its money the owner took out of the company to use for personal expenses.

Tabular Representation of Modern Classification Of Account

SN. Types of Account Account to be Debited Account to be Credited

1. Assets account Increase Decrease

2. Liabilities account Decrease Increase

3. Capital account Decrease Increase

4. Revenue account Decrease Increase

5. Expenditure account Increase Decrease

6. Withdrawal account Increase Decrease

Call 0803 239 3958 for free financial consulting advice for your businesses.

Send your accounting articles to blog@skytrendconsulting.com.

READ ALSO! PAYE: How to calculate personal income tax

READ ALSO! Skytrend Consulting: Financial services and accounting solutions company

READ ALSO! For failing to give out ‘adequate loans’, 12 banks fined N499bn

READ ALSO! Nigerian Central Bank Approves Disbursement Of Loans For Creative Industries At 9%

READ ALSO! How To Empower Yourself And Generate Income From Mutual Funds

READ ALSO! Is N-Power Truly Empowering Nigerian Youths?

READ ALSO! TraderMoni: Poverty Alleviation Or Political Leverage?