With the advent of computer and digital technology, businesses do no longer have to burden themselves or their accountants with endless manual systems of recording their daily financial operations. Accounting software for small businesses has become affordable and many of them are available for effective and timely reporting to aid quality management decision making.

What Is An Accounting Software?

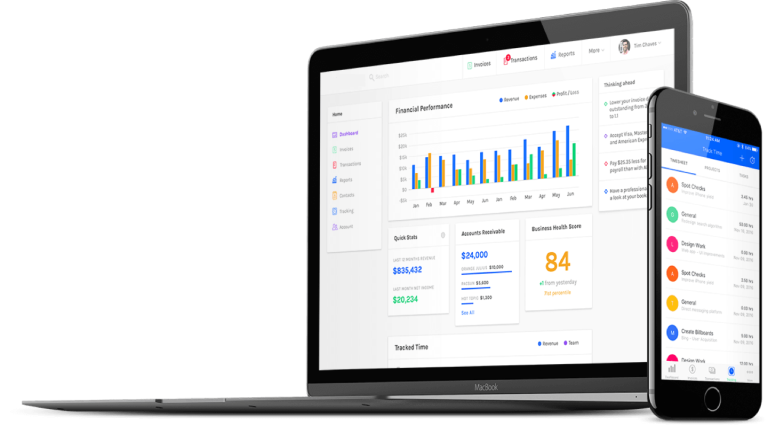

Accounting software is a computer program that allows the automation of financial records and processes and assists accountants, store managers, consultants, and business owners in maintaining, posting, reporting, and monitoring an organization’s financial transactions within a functional system.

A good accounting software solution contains menus such as customers, vendors/suppliers, sales ledger, purchases ledger, accounts receivable, accounts payable, journal, payroll, fixed asset, direct cost (cost of sales) and indirect cost (administrative expenses), assets, liability, general ledger, trial balance, income statement, media expenses, and income, advertising expenses, PR Expenses, etc, balance sheet, etc. which simplify the processes of accounting record entries and reporting. A good accounting software, therefore, functions as a complete accounting information system.

Are you thinking of getting ACCOUNTING SOFTWARE for your business anywhere in Nigeria? Hotline Call or Whatsapp Skytrend Consulting on 0803 385 7245 any hour of the day. Our Consultants will be glad to attend to you and give you free consultancy for implementing accounting software for any type of business you manage.

With it, you can maintain and manage sales/customers and purchases/vendors, generate and post ledger accounts of daily business transactions, generate reports, manage and track stock levels, bill customers, complete inventory management and monitor cash and bank account movement and balances.

Skytrend Consulting is an accounting software solution company incorporated in Nigeria in 2013. When it comes to implementing budget friendly, affordable, and effective accounting software for small businesses in Nigeria, we are the expert! Many SMEs in Nigeria fail in the first 5 years due to improper financial recording processes.

With an accounting software customized for your small or medium scale business, SMEs, you do not have to suffer this failure anymore, you can easily then focus on the strategic aspect of building your business.

The Digital Evolution And Accounting Software For Small Businesses In Nigeria

No matter how small or big your business is, managing its financial side can be frustrating. Thanks to the digital evolution, you can overcome that stress and have the best accounting software solution for your business to do all the heavy financial recording and tasks for you.

Once you find your top accounting software among all that’s out there, you will be able to do away with Excel and Google spreadsheets and get into the world of proper accounting and double entry principles. Our accounting software for small businesses in Nigeria will definitely turn your SME around for proper financial procedures and effective internal control processes.

How Does Accounting Software For Small Business In Nigeria Work?

Once a business’ bank accounts and credit cards are synced with the accounting software, transactions will appear in a queue and can be classified into the categories found on the business’ chart of accounts. After selecting the proper category, transactions begin to populate the business’ financial statements.

Small business owners can run a financial report in seconds to review profitability, compare revenue and costs, check bank and loan balances, and predict tax liabilities. Having quick access to this financial information gives business owners the power to make important decisions.

Additionally, many accounting software allows third-party application integrations. For example, if a business owner uses a point of sale (POS) system to capture sales transactions, the POS system could potentially integrate with the accounting software to record specific transactions, sales tax liabilities, sales by subcategories, and more.

Different Types of Accounting Software for Small Businesses In Nigeria

There are many different types of accounting software for small businesses in Nigeria, with varying capabilities and price tags. Generally, the type of industry and number of employees are two factors that can help a small business owner begin to choose the accounting software that is appropriate.

If accounting isn’t your strength or even if it is and you want to save time, read on to see which accounting software is right for your small business.

- Sage 50 Accounting Software

- FreshBooks Accounting Software

- QuickBooks Accounting Software

- SAP Accounting Software

- Xero Accounting Software

- Zoho Books Accounting Software

- AccountEdge Pro Accounting Software

- Wave Accounting Software

- ZipBooks Accounting Software

- Sage Business Cloud Accounting Software

- Tally Accounting Software

- Busy Accounting Software

- Godaddy Accounting Software

1. Sage 50 accounting software

Sage 50 Accounting Software is the first and foremost and leading accounting software for small businesses in Nigeria. It has become industry standard in the evolving business of accounting solution implementation. This is because it’s very simplified, easy to learn, and use even by accountants and nonaccountants in Nigeria and all across the globe.

The solution is easily customizable for many types of business organizations such as hotels, restaurants, bar, manufacturing, consultancy businesses, service businesses, trading businesses, schools etc.

Sage 50 accounting software helps organizations achieve more by simplifying everyday tasks so you can get more work done, helps you get to your data faster, and provides tools to help increase organizational efficiency and financial recording accuracy.

Specifically, the software has features to set out your charts of accounts as a hotel and implement a workable system that gives you daily, weekly, monthly reports of your business and finances. With Sage 50 accounting software, you can easily determine your turnover, direct & indirect cost, profitability (both gross and net) separately and combined from room sales.

If you own or manage a hotel, Sage 50 robust accounting and inventory management modules will simply your room sales, restaurant sales, bar sales, and other additional lines of income such as swimming pool, gym, and laundry. This will let you easily determine if your hotel is making a profit or not and how much.

The solution also delivers to you which department is making the greatest sales and costs attributable to such department. This is equally true and customizable to whatever type of business you manage, Sage 50 has an effective and customizable system for your small business.

To book a call or make inquiries with our Sage 50 Accounting Software Expert in Nigeria, call 0803 385 7245 or CLICK HERE.

2. FreshBooks Accounting Software

FreshBooks is number 2 on our list of accounting software for small businesses in Nigeria and has long been the best accounting software in the freelancing space. With FreshBooks, you can manage all the financial operations from a single dashboard.

SAGE 50 PEACHTREE ACCOUNTING SOFTWARE – ALL YOU NEED TO KNOW

You will definitely like the user-friendly interface of this solution. To take the functionality to another level, they prioritized integrations. You can use it with platforms including PayPal, WordPress, Mailchimp, Zendesk, and more.

FreshBooks’ features include:

Payment reminders

Recurring invoices with customizable options including due dates and discounts

Online credit card payments

Multi-currency and language billing

Automatic tax calculations for sales tax

Tax-friendly expense categories

Remembered vendors

Time tracking with a Chrome browser extension

Bank deposits, recurring payments, and auto bills with bank integration

Tax help integrations with tax apps, estimates, deductions, and filing tools

Easily integrates with other products including Goggle Workspace and Gusto

3. QuickBooks Accounting Software

QuickBooks is number 3 on our accounting software for small businesses in Nigeria and it was developed and marketed by Intuit. Its latest cloud-based release was in 2019, but it also offers separate desktop options you can purchase and download. Its products are typically geared toward small and medium-sized businesses, and over seven million businesses use this software.

Not only do the majority of small business accounting professionals use QuickBooks Online, but there are also endless online training resources and forums to get support when needed. All accounting features can be conveniently accessed on one main dashboard, making bookkeeping more fluid and efficient.

QuickBooks features include:

Mobile access

Track income and expenses

Capture and organize receipts

Payroll processing

Send estimates

Track sales and sales tax

Shopify and PayPal integration

Connect bank/credit card accounts

Manage accounts receivable

Invoice and accept payments

30-day free trial

Multiple users (up to 25)

Receipt capture

4. SAP Accounting Software

SAP, an acronym for System, Application, and Products is one of the leading business software providers in the world and a top on the list of accounting software for small businesses in Nigeria. It is an integrated enterprise system mostly used by big companies. It can also be used by small and medium-sized businesses.

The software is one of the leading solutions for your small business. SAP which is abbreviated for System, Application, and Products, has gone on to establish itself as the fourth largest in the world.

The beauty of SAP is that it can be thoroughly customised – with codes and social departmental designations – to fit a specific company. It is even better in the sense that it allows you to account for not only money but physical goods too.

Keeping inventory, raising product orders and reservations and managing/ manipulating stock are just some areas where SAP finds application in the industrial sphere. For well-rounded accounting software, this delivers every time.

The software helps you manage your sales tax, finances, and account reports. Not only does it manage your finances but also physical goods. It can be used to keep track of inventory, raise product orders, manage reservations and stock. SAP can also be used to manage relationships with customers and potential customers. The interesting thing about SAP software is that it can be customized to fit a specific company’s needs.

5. Xero Accounting Software

Xero is another top accounting software solution for small businesses in Nigeria. This software has a clean interface and also fully integrates with a third-party payroll service. Businesses can collect payment online from customers through Xero’s integration with Stripe and GoCardless.

Pros

A cloud-based, Mobile app, Payroll integration with Gusto, Third-party app marketplace, Simple inventory management

Cons

Limited reporting, Fees charged for ACH payments, Limited customer service

Xero was founded in 2006 in New Zealand and now has over two million users worldwide. This accounting software is popular in New Zealand, Australia, and the United Kingdom. Xero has over 3,000 employees and is growing rapidly in the U.S., as well.

Features of Xero include

Send invoices, track them, see when the client sees them

Inventory tracking

Reconcile bank transactions

800+ business apps

Connect to your bank

Exceptional online support

Track payroll

Pay your bills via Xero

Mobile app

Multi-currency

Calculate sales tax

6. Zoho Books Accounting Software

Zoho Books is simple yet scalable accounting software for those who are self-employed and those who want to start a small business. This makes it a unique option on our list of the best accounting software for small businesses.

Payroll offering is limited in this option, though. Zoho Books offers excellent cloud accounting for micro-businesses. It is easy to use and budget-friendly. Features are limited, but you can use additional Zoho tools (like Zoho CRM) to boost the functionality as your business grows. Or, you can opt for the complete, all-in-one solution called Zoho One.

Features of Zoho Books include:

Create invoices in seconds

Send payment reminders

Give customers online payment options

Upload expense receipts

Track inventory

Bank reconciliation

Invoice templates

14-days free trial

Operates in multiple languages

Stripe compatible

Project billing

Time tracking

Create, edit, and manage your customer and supplier contacts

6. AccountEdge Pro Accounting Software

AccountEdge Pro is desktop accounting software for small businesses founded in 1989 and has developed new features and enhancements over the years. If you need to access your finances on the go or from your smartphone, you can use their cloud-based app or their hosting platform. It’s geared toward small to medium-sized businesses, has a basic version and a pro version, and offers comprehensive accounting solutions full of customizations.

We chose AccountEdge Pro as our best accounting software for experienced accountants because of its robust features and reporting capability. It’s a bit more complex than some of the other software, so this software works best if you’re already familiar with accounting terminology.

AccountEdge Pro’s features include:

Bank feeds with integration

Direct deposit

Inventory management

Payment processing

Turn quotes into invoices

Customer and vendor management

Full-service payroll

Free accountant copy

Data sync with company files

7. Wave Accounting Software

Wave is powerful accounting software for small businesses in Nigeria and also for individual contractors. It places significant emphasis on ease of use and synchronicity —letting you link your bank accounts, track your expenses, and balance your books without any trouble. It also lines up with Wave’s additional resources, providing you with an all-in-one solution if you opt to invest in its other products.

The accounting software was founded in Toronto in 2009 and provides software and financial services for small businesses. It’s an invoicing and accounting software that also has credit card processing and payroll services.

It’s cloud-based, easy to use, and can be used by business owners with no accounting or bookkeeping experience. All of your data is backed up for extra security, and you can connect your bank accounts to sync your expenses at any time from anywhere.

Wave accounting software and invoicing services are free. Keep in mind that payroll services and credit card processing have charges associated with them, so not all of the features are free, and the free features aren’t as robust as some of the other software options. However, it’s great for new businesses, especially those working with an accountant or another software.

Wave Accounting’s features include:

Unlimited income and expense tracking

Track sales tax on income and expenses

Double-entry system

Multiple users

Dashboard with easy-to-read financials

Organize income and expenses into tax categories

Reports including profit and loss statements and cashflow

8. ZipBooks Accounting Software

ZipBooks is a free cloud accounting software for small business owners. You can use it for free if you’re okay with the limitations. But the good news is that the paid plans are quite affordable as well.

With the free version, you can send invoices, manage suppliers/customers and accept digital payments. They have sophisticated features in the premium version for small and mid-sized business owners.

Features of ZipBooks include:

Send unlimited invoices

Manage unlimited vendors and customers

Connect a bank account

Accept payments via Square and PayPal

Payroll processing

Automated reminders (premium)

Dedicated bookkeeper (premium)

Time tracking (premium)

Account reconciling (premium)

9. Sage Business Cloud accounting

Sage Business Cloud Accounting is an upgraded version of sage 50. It is designed specifically for small businesses. The solution has a platform for accounting, payroll enterprise management, customer sales history, expense management, project accounting, compliance management capabilities, and much more.

It is a global brand that offers online accounting and business services for small businesses. It was founded in 1981 in Newcastle, England, as a way to develop estimating and accounting software specifically for small businesses.

With Sage, you can spend less time on administrative tasks. The software sends invoices, tracks payments and expenses, and calculates what you owe come tax season. Time-tracking and collaboration tools are two things you won’t get with Sage, and payroll is a separate product.

Sage also works well for medium-sized businesses. If your small business is more mature than most — and you can afford to spend a little extra on your accounting software — take a look at Sage50cloud.

Sage Business Cloud Accounting’s features include:

Manage business finances and cash flow

Accept and receive payments

Create and send invoices

Manage payroll

Available on all devices so you can check your financials on the go

Integrate with your financial institution and other apps including AutoEntry, Zync, and more

Tax compliance tools

Dashboard view with easy-to-read financial reports and analysis

Inventory control

Forecast cash flow

Share access with your accountant in real-time on any device

Add-ons such as human resources management and estimating

10. Tally Accounting Software

Tally is Indian-made. It provides you with great error detection and correction capabilities. Other functionalities provided by tally include accounting, finance, inventory, sales, purchase, point-of-sales, manufacturing, payroll, Inventory control, discount, collection reports generated, and branch management.

Tally contains a platform that carries out accounting aspect support tasks such as voucher management, bank account integration, and payment reminder letters. It also has a sales module platform that records receivables, payables, billing, Invoicing, etc. This software is also made up of Shortcut Keys.

12. Busy Accounting Software

Busy Accounting software helps your accounting team to work with great precision and order. It is best suited for small and medium businesses especially those in FMCG, Retail, Trading, Manufacturing, Distribution, and Service as it helps them manage their business efficiently.

The solution also supports accounting processes such as configurable Invoicing, Financial Accounting (Multi-Currency), multi-Company Accounting, Payroll Management Sales / Purchase Quotations, multi-branch management, and more. Tax management is one of its key functionalities.

13. Godaddy accounting software

Established in Baltimore, Maryland, in 1997, GoDaddy is a big name in the web hosting and website creation space, but it also offers accounting software for small businesses. It has tools to automate and organize your bookkeeping and accounting solutions and requires no prior accounting knowledge. You can automatically create and send invoices, accept online payments, and view business reports.

GoDaddy accounting software is purpose-made for e-commerce businesses, so you can get started in a few minutes, and it syncs to Amazon, Etsy, eBay, PayPal, and more. Keep in mind that GoDaddy is great for online sellers, but may fall short if you’re a small business looking for comprehensive accounting solutions including automation, tax forms, and payroll.