Sage 50 Peachtree Accounting Software – All you need to know

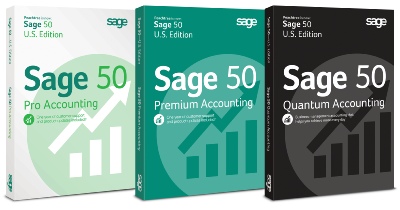

What are the differences between the Sage 50 products?

Sage 50 Accounting software solution serves the needs of customers, including those automating their accounting for the first time, to seasoned, advanced users needing to consolidate financials for multiple companies. Please see attached for product comparism for Sage 50 Complete, Premium and Quantum Accounting software.

What Special Industry Solutions are offered by Sage 50?

Apart from the regular solutions of Sage 50 Complete, Sage 50 Premium & Sage 50 Quantum Accounting software, Sage 50 product line also offers specific solutions for Construction, Distribution, Manufacturing, and Nonprofits.

As my business grows, can Sage scale to meet my needs?

Sage offers solutions that will serve your needs throughout the life cycle of your company. Start with the Sage 50 solution that meets your needs and budget today, and as your requirements grow, upgrade to the next level of software when the time is right. Sage can truly support you through all phases of your business.

Why should I choose Sage 50 over QuickBooks?

Sage 50 offers superior quality and service, including robust functionality in inventory, job costing, time and billing, and fixed assets. Built-in accounting controls and detailed security provide the accuracy and control needed to run your business, giving you the peace of mind you deserve.

Additionally when you choose Sage 50 you can get direct access to our US-based technical support.

Can I convert from QuickBooks®?

Sage 50 Accounting offers an easy conversion wizard only for QuickBooks* to walk you through the steps, allowing you to get up and running in no time. Sage 50 supports conversions from QuickBooks 2007 – 2011 Pro through Enterprise.

*Excludes conversion of QuickBooks individual payroll transactions. For additional information on conversion limitations, please visit www.Sage50Accounting.com/qb

Getting Started with Sage 50:

What features are available in Sage 50 Accounting 2013 to get me started quickly?

All products come with a New Company Setup Wizard to walk you through the steps of setting up your accounting, as well as in-product tips and screen-level help, which tells you what info you should have on hand prior to setting up Sage 50.

Once I have Sage 50 Accounting 2013, how do I know what features are available and how to use them?

Our “What’s New in Sage 50” screens will walk you through all the new features in Sage 50 Accounting2013, plus tell you how to use them. This feature automatically displays when you first launch the product, and also has a link in the Help file so you can access it whenever you need it.

How many companies can I consolidate?

Provided that your companies have the same chart of account IDs, Sage 50 allows you to run up to 20 customized Financial Statements in consolidated format.

Support Questions:

What is the maximum number of users supported by Sage 50?

For our Sage 50 Complete, Premium Accounting and Industry Solutions products, you have the option to support up to 5 licensed, named users.* Sage 50 Quantum Accounting 2013 offers you the opportunity to support 5, 10, 15, 20, 30 or even 40 licensed, named users**.

*For multi-user access, you must purchase one single-user box per named user or one Multi-user Edition for up to five licensed, named users. **Multi User licenses available in of packs of 5, 10, 15, 20, 30 or 40. A maximum of 40 licensed, named users is allowed. Only the first 40 named users selected in the user maintenance screen are considered licensed, named users.

How many years will the Multi-Year* Reporting feature go back?

With an upgrade to Sage 50 Accounting 2013 or an earlier product, you will be able to see ‘real-time’ financial statement information from your current open 2 years plus 1 closed year, all within Sage 50. Once you upgrade to Sage 50 Accounting 2013, your historical information will begin to build year over year. Sage 50 Accounting 2013 and previous versions have no restrictions on how far back you can report for transactional data like sales order reporting, only for financial statements, account balances, and payroll reports.

*Upon upgrading to Sage 50 Accounting 2013, 3 years of converted Sage 50 Financial Statement data and account balance data on General Ledger reports will be readily accessible, as well as data for future closed years.

Within the Multi-Year* reporting feature, will the data being viewed in my closed year be altered?

No, one of the advantages of Sage 50 is that we lock-down all closed year information. This feature will allow you to see the information without concern of changes occurring.

*Upon upgrading to Sage 50 2013, 3 years of converted Peachtree Financial Statement data and account balance data on General Ledger reports will be readily accessible, as well as data for future closed years.

Sage 50 Add-on Services:

Does Sage 50 offer the ability to access my data remotely?

Yes, with Sage 50 Remote Access* powered by GoToMyPC®, you will be able to access your Sage 50 data from any other computer with Internet access any where in the world.

*Additional fees, internet access and credit card required. Subject to third party terms and conditions. Price is subject to change.

Sage 50 Other Questions:

Do I have to pay any yearly maintenance fee after buying Sage 50 (Peachtree)?

No, you do not pay any yearly maintenance fee. You only need to pay for one-time Sage 50 (Peachtree) software license. We provide Sage 50 (Peachtree) set-up, training and support, which we charge only when you require these services.They are not compulsory.

Do I need to know accounting to use Sage 50 (Peachtree)?

No, you do not need to know accounting to do data entry in Sage 50 (Peachtree). We can set up Sage 50 (Peachtree) for you, then train you how to use it. Our accountants can review and adjust your accounts after your data entry.

For how long can I use Sage 50 (Peachtree)?

You can use Sage 50 (Peachtree) for several years. You may wish to upgrade to latest version of Sage 50 (Peachtree) when it offers new features which you need, or when your new operating system does not allow export from your older version of Sage 50 (Peachtree) reports to xls file.

Can I use Sage 50 (Peachtree) for more than 1 company?

Yes, you can create up to 20 companies in Sage 50 (Peachtree)

What modules does Sage 50 (Peachtree) have?

Sage 50 (Peachtree) has integrated modules including general ledger, sales and receivables, purchases and payables, inventory, financial management, Job/ project management, payroll, system security and fixed assets.

How many standard reports does Sage 50 (Peachtree) have?

Sage 50 (Peachtree) has more than 150 standard reports. You can use Financial Wizard to build your own financial reports. Sage 50 (Peachtree) Premium includes Crystal Report Writer which provides enhanced and advance reporting.

Does Sage 50 (Peachtree) provide audit trails?

Yes, Sage 50 (Peachtree), except for Sage 50 (Peachtree) Pro, provide audit trails.

Can I view online reports after data entry?

Yes, you can set to post transactions on real time or batch basis.

How long has Sage 50 (Peachtree) been in the market?

Sage 50 (Peachtree) has been established for more than 40 years.

How often are enhancements to Sage 50 (Peachtree)?

Sage 50 (Peachtree) is enhanced every year – new release is available every year

Where is Sage 50 (Peachtree) made?

Sage 50 (Peachtree) is made in USA

Can I export Sage 50 (Peachtree) reports to Excel xls file?

Yes, you can export Sage 50 (Peachtree) reports to Excel xls file.

Can I import data into Sage 50 (Peachtree)?

Yes, you can import data in CSV format into Sage 50 (Peachtree).

What are the benefits of using multi-user version of Sage 50 (Peachtree)?

Up to 5 users (Sage 50 Complete & Premium), and up to 40 users (Sage 50 Quantum) can enter data into Sage 50 (Peachtree) common database at the same time

Can Sage 50 read earlier versions of Peachtree files?

Yes, when you upgrade to Sage 50 software, data conversion from Peachtree software is automatic provided you are on the same or higher product range, and Peachtree is in Windows version. E.g., Sage 50 Complete can read files from Peachtree Complete, but Sage 50 Pro cannot read files from Peachtree Complete, since Pro is a lower version

Can Sage 50 take Billion digits in its Amount and Inventory fields?

Yes, Sage 50 software can take Trillions (14 digits) and not just Billions in its Amount and Inventory fields. Upgrading to Sage 50 will solve all your former Peachtree Millions (9 digits) Amount field and Inventory field limitations.

You can reach us on telephone/whatsapp message on 08033857245 or 0803 239 3958. You can also send us an email info@skytrendconsulting.com

Need an accounting software solution for your business? Whatsapp us on 0803 239 3958. You have an article or review on financial implementation or an accounting solution you want us to publish, send to blog@skytrendconsulting.com.

READ ALSO! Accounting software implementation: 5 key stages in a new accounting system

READ ALSO! Skytrend Consulting: Financial services and accounting solutions company

READ ALSO! Why The North Remains Headquarters Of Poverty In Nigeria — Kingsley Moghalu

READ ALSO! For failing to give out ‘adequate loans’, 12 banks fined N499bn

READ ALSO! BBNaija Dorathy Launches Lingerie Line, Says Priority Is Making Busty Women Look Good

READ ALSO! How To Empower Yourself And Generate Income From Mutual Funds